Other Ways to Give

Planned Giving, Securities, Insurance and Gifts-in-Kind

In addition to one-time donations and monthly pledges, Rundle is able to accept bequests, securities, insurance policies and gifts-in-kind. These alternate giving options create a significant impact and can provide additional tax benefits individuals and estates.

A charitable bequest is an option to give to Rundle and can offer significant tax relief to a donor’s estate. A bequest made to Rundle is eligible for a tax receipt applicable to the donor’s estate and can be applied to the donor’s final income tax return and offset taxes payable by the estate.

The proceeds from Registered Retirement Savings Plans (RRSPs) and Registered Retirement Income Funds (RRIFs), and life insurance policies provide an excellent way to make a planned gift to Rundle. If a donor chooses to leave a portion of their retirement funds to Rundle, they will go directly to Rundle tax-free.

In all cases we recommend that they be carefully reviewed by our donors and their legal counsel to ensure accuracy.

For more information about this and other giving options, please contact us at giving@rundle.ab.ca

The donation of an insurance policy can be a cost effective way to create a substantial legacy gift. By naming Rundle College as the beneficiary on a new or existing insurance policy, you can create a significant future gift by making modest, regular payments over a selected time period. There are many benefits to this giving option, including immediate or final estate tax benefits for policy premiums paid and an increase in the overall financial value of your gift upon payout.

For more information about this and other giving options, please contact us at giving@rundle.ab.ca

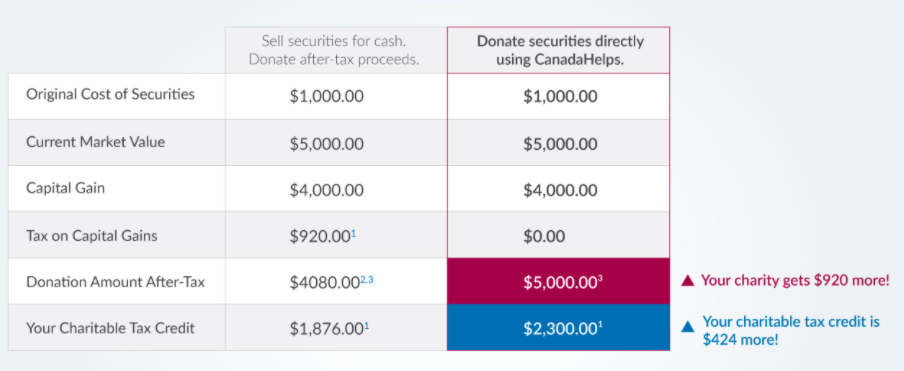

You can donate Canadian securities to Rundle. When you donate securities directly to Rundle College, capital gains tax is eliminated, allowing you to increase the impact of your donation.

For more information about this and other giving options, please contact us at giving@rundle.ab.ca

We do accept gifts-in-kind if they benefit our programs. e.g. equipment, furniture, materials and resources that can be utilized to support our programs or enhance our learning environment. Please contact us to discuss the nature of your gift-in-kind to ensure it will be used appropriately.

For more information about donating gifts-in-kind, please contact us at giving@rundle.ab.ca